The Spanish government has reduced VAT on new build homes, cutting it from 8% to 4% in an effort to stimulate the country’s struggling housing and construction industries. According to the most recent statistics new home sales in Spain are down 26% compared to last year.

Government spokesman Jose Blanco described the measure as “extraordinary” and “temporary” in a press conference, saying it would remain in effect only until December 31st, 2011. It is part of a larger plan aimed at both fiscal consolidation and supporting a stalled Spanish economy. Read More →

Erica Evans is Director of expat property consultancy Expatfindaproperty.com

Expats investing in London property could improve their yields by 10% just by researching the market more carefully, found a recent report from Offshoreonline.org. Many overseas buyers look at average figures for the city when making purchases, ignoring critical variances across specific neighborhoods. Expat Wealth spoke to Erica Evans, Director of Expatfindaproperty.com, to get the full scoop on the market.

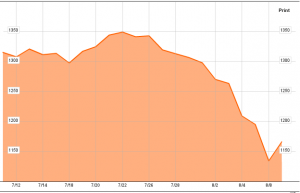

To say it’s been a rough couple weeks for global financial markets is putting it lightly. Equities have been falling for over two weeks now as investors abandon stocks for traditional havens such as gold, the Swiss franc, the Japanese yen and (ironically, enough) US Treasuries (the latter despite Standard & Poor’s downgrading the US’ credit rating to AA+).

These options are far from inspiring, however. Gold isn’t nearly liquid enough–having already breached USD 1,700 an ounce–and both the Swiss and Japanese governments are working to tamp down currency values. Meanwhile, the issue with Treasuries isn’t default risk so much as plunging interest rates: 10-year bonds currently yield 2.15%, down from 3.01% only a month earlier.

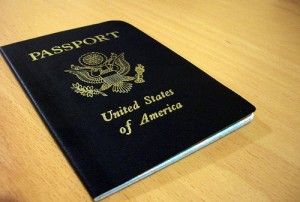

Cyprus has seen a marked increase in property sales to foreigners, reported Overseas Property Professional, particularly to Russian and Chinese buyers. The most recent figures put the volume of land sales up nearly 20% over 2010–43% in the Larnaca area alone. This despite the looming storm clouds of the eurozone’s ongoing debt crisis and Cyprus’ own financial woes.

Cyprus has seen a marked increase in property sales to foreigners, reported Overseas Property Professional, particularly to Russian and Chinese buyers. The most recent figures put the volume of land sales up nearly 20% over 2010–43% in the Larnaca area alone. This despite the looming storm clouds of the eurozone’s ongoing debt crisis and Cyprus’ own financial woes.

OPP attributed the surge to government incentives providing foreigners with legal protections and residence visas in return for property investments. The site quoted the head of Imperio Properties, Yiannis Misirlis, who said:

There has been a noticeable percentage increase in business from Russian and China […] our system that makes overseas property buyers eligible for a residential visa. The Russians have been aware of the rule for several years now and like to take advantage of it.

A report from international mortgage specialist Offshoreonline.org showed buyers could gain as 12% by researching locations more carefully. Its conclusions were based on data from the UK Land Registry.

A report from international mortgage specialist Offshoreonline.org showed buyers could gain as 12% by researching locations more carefully. Its conclusions were based on data from the UK Land Registry.

Many expat investors look at average figures across regions or cities when buying real estate, when in fact prices may vary significantly across individual neighborhoods. In London, for example, prices in Islington have risen 8.5% over the past 12 months, while those in Bexley have fallen 3.4%.

Expats in Saudi Arabia face the prospect of frozen bank accounts as the Kingdom tightens up its immigration laws, reported Arabian Business.com’s Elizabeth Broomhall:

Foreign workers, whose bank accounts are frozen during visa renewals, fear rules aimed at forcing private sector firms to increase their quota of Saudi employees will leave them unemployed, unable to access their cash, and struggling to find a new job.

‘The feeling is of fear and uncertainty,’ said a Filipino office administrator, who asked not to be named. ‘If my iqama [residency visa] expires and is not renewed, my bank account will be frozen. Once your bank account is frozen, no money can be taken from it. Your driver’s license is also frozen, credit cards as well.’

‘If you get a new job without a valid iqama, you only expose yourself to further exploitation – you can get jailed if you are found.’

Expats have a lot on their plates when moving: housing, schooling for children, visas and permits… the list goes on. It’s no wonder many expats fail to make proper financial arrangements before relocating—a costly (and thoroughly avoidable) mistake. Below we’ve identified the 5 essential steps for effectively managing your finances abroad.

Expats have a lot on their plates when moving: housing, schooling for children, visas and permits… the list goes on. It’s no wonder many expats fail to make proper financial arrangements before relocating—a costly (and thoroughly avoidable) mistake. Below we’ve identified the 5 essential steps for effectively managing your finances abroad.

1. Open two bank accounts. You’ll want one bank account in your host country and one at home. Even as an expat you may continue to have financial obligations in both countries. Fund each account with enough to cover 3-6 months worth of expenses. The last thing you want is to have to border-hop to exchange currencies. Use big, reputable banks for both accounts. Larger banks usually offer better exchange rates, higher quality services (such as faster wire transfers) and more robust websites.

2. Establish two credit cards. This goes hand-in-hand with Step 1 above. Having credit cards denominated in two currencies will protect you from large fluctuations in exchange rates, as well as foreign transaction fees.

Mercer has released its 2011 Cost of Living Survey, allowing expats to see where their dollar will go furthest. The survey is based on two key data points: the relative strength or weakness of the local currency against the US dollar over the last 12 months and price movements relative to a baseline (New York City) during the same period. Mercer determined Karachi, Pakistan was the cheapest expat destination in the world and Luanda, Angola the most expensive. The rest of the five most expensive cities were Tokyo, Japan; N’Djamena, Chad; Moscow, Russia and Geneva Switzerland.

Mercer has released its 2011 Cost of Living Survey, allowing expats to see where their dollar will go furthest. The survey is based on two key data points: the relative strength or weakness of the local currency against the US dollar over the last 12 months and price movements relative to a baseline (New York City) during the same period. Mercer determined Karachi, Pakistan was the cheapest expat destination in the world and Luanda, Angola the most expensive. The rest of the five most expensive cities were Tokyo, Japan; N’Djamena, Chad; Moscow, Russia and Geneva Switzerland.

Mercer’s Senior Researcher in charge of compiling the rankings, Nathalie Constantin-Métral, explained their importance:

Multinational companies have long understood the competitive advantage of a globally mobile workforce, though the enduring challenge is to balance the cost of their expatriate programmes. Currency fluctuations, inflation, political instability and natural disasters are all factors that influence the cost of living for expatriates. It is essential that employers understand their impact, for cost-containment purposes but also to ensure they retain talented employees by offering competitive compensation packages.

Some time ago Time’s Helena Bachmann observed a growing phenomenon among American expats: renouncing their citizenship for tax reasons. Bachmann’s story was written in the spring of 2010, and noted

Some time ago Time’s Helena Bachmann observed a growing phenomenon among American expats: renouncing their citizenship for tax reasons. Bachmann’s story was written in the spring of 2010, and noted

According to government records, 502 expatriates renounced U.S. citizenship or permanent residency in the fourth quarter of 2009 — more than double the number of expatriations in all of 2008. And these figures don’t include the hundreds — some experts say thousands — of applications languishing in various U.S. consulates and embassies around the world, waiting to be processed. While a small number of Americans hand in their passports each year for political reasons, the new surge in permanent expatriations is mainly because of taxes.

A June 2011 piece on The New York Times’ blog found that trend little changed. Catherine Rampell wrote that 499 expats renounced their citizenship in the first quarter of 2011, up from an average of 115 for the previous seven years.