The US has imposed steep penalties on expats who fail to report their overseas assets.

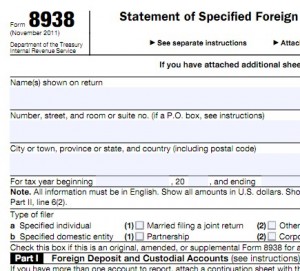

2011 is drawing to a close and with it the tax year. In keeping with the seasonal spirit, the US government has given expats an early Christmas present: a revised Form 8938.

The new form is an integral part of the Foreign Account Tax Compliance Act (FATCA), designed to punish tax cheats with overseas assets. But it could also hurt wealthy expats who fail to properly report overseas assets.

American expats face a minimum USD 10,000 penalty for non-compliance. An additional USD 50,000 fine can be applied for further failures to meet reporting requirements.

But by far the harshest provision is a potential 40% penalty applied to any unreported assets.

This law applies only to wealthy expats:

- Unmarried expats with foreign assets worth USD 200,000 on the last day of the tax year (or USD 300,000 at any time during the year).

- Married expats are exempt up to USD 400,000 on the last day of the tax year (USD 600,000 at any time of year).

To avoid the crushing fines, expats must file Form 8938 this coming tax year. It should be submitted alongside their annual income tax return.

For more on Form 8938 and how to file, visit the IRS guidelines.