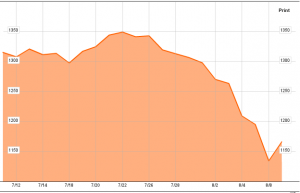

To say it’s been a rough couple weeks for global financial markets is putting it lightly. Equities have been falling for over two weeks now as investors abandon stocks for traditional havens such as gold, the Swiss franc, the Japanese yen and (ironically, enough) US Treasuries (the latter despite Standard & Poor’s downgrading the US’ credit rating to AA+).

These options are far from inspiring, however. Gold isn’t nearly liquid enough–having already breached USD 1,700 an ounce–and both the Swiss and Japanese governments are working to tamp down currency values. Meanwhile, the issue with Treasuries isn’t default risk so much as plunging interest rates: 10-year bonds currently yield 2.15%, down from 3.01% only a month earlier.

So are there any safe harbors left for expat investors?

Two days ago The Financial Times‘ Lex column suggested investors look to under-valued large-cap stocks, writing:

it is hard to see bonds or the dollar acting as havens again. On Monday both gained, in a perverse reaction, but 10-year yields of 2.35 per cent leave scant room for gain – they were above 4 per cent when Lehman fell.

Instead, cheap large-cap stocks with strong balance sheets that produce cash and gain from a weak dollar look to be the best available havens.

Lex suggested both Wal-Mart and Microsoft as examples.

Another possibility is property. Slowing growth and a state of perpetual fiscal crisis within the eurozone should ensure interest rates remain low for some time yet, bringing mortgage rates down with them. In some areas property values have yet to recover from the 2008 financial crisis, and certain countries offer both residency and tax incentives for property investors.

Even here, however, liquidity remains a risk. Hence, expats who may need to sell assets quickly should still carefully consider the pros and cons of any overseas property purchases.